Maximizing Your Investments With Compound Interest

In the realm of personal finance, few concepts wield as much power and promise as compound interest. Often hailed as the 'eighth wonder of the world' by investment gurus, its ability to exponentially grow wealth over time is unparalleled. Yet, despite its significance, compound interest remains a nebulous concept for many.

This article aims to demystify this financial phenomenon, illuminating how it functions as the cornerstone of savvy investment strategies. By understanding and harnessing the power of compound interest, investors can not only preserve but significantly enhance their financial well-being.

Basic principles of compound interest

At its core, compound interest is interest earned on interest. This fundamental principle differentiates it from simple interest, where earnings are generated only on the principal amount. To comprehend its impact, consider the formula: A = P(1 + r/n)^(nt), where A is the amount of money accumulated after n years, including interest, P is the principal amount, r is the annual interest rate, and n is the number of times interest is compounded per year.

A practical example

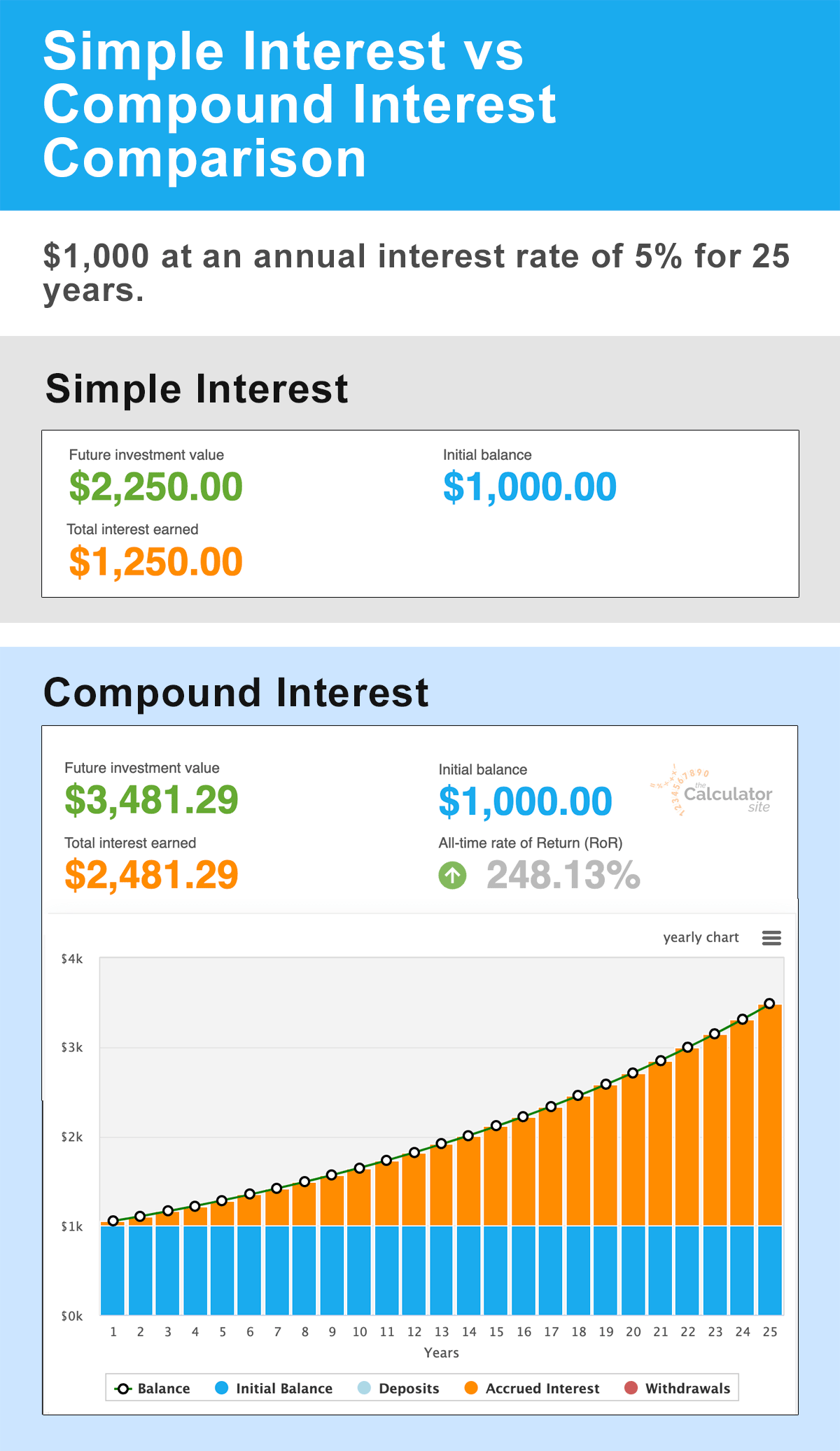

Suppose you invest $1,000 at an annual interest rate of 5%. With simple interest, you would earn $50 each year. However, with compound interest, your earnings in the second year would be calculated on $1,050, not just the initial $1,000, resulting in slightly more than $50. Over time, this difference becomes significantly amplified. Here's a comparison of how your investment could look after 25 years...

As you can see, you'll have earned almost twice as much interest thanks to the magic of compounding as you would with simple interest alone.

The power of compounding frequencies

The frequency of compounding plays a crucial role in the growth of your investment. Essentially, the more frequently interest is compounded, the more you earn. Let's explore this with three compounding frequencies: daily, monthly, and yearly.

Imagine an investment of $10,000 at an annual rate of 5%. Compounded yearly, it would grow to about $16,289 in 10 years. Monthly compounding at the same rate elevates it to approximately $16,470, while daily compounding boosts it further to around $16,487. The differences might seem modest in the short term, but over decades, they can amount to thousands of dollars.

To illustrate this visually, consider a graph plotting these scenarios over a 30-year period. The lines representing daily and monthly compounding rise steeper than the yearly one, clearly showing the cumulative impact of more frequent compounding over time.

By understanding the mechanics and implications of compound interest and its frequencies, investors are better equipped to make informed decisions that could significantly impact their financial future. The next sections will delve deeper into how compound interest influences various investment vehicles and how best to utilize online calculators to maximize investment returns.

Compound interest in various investment vehicles

Compound interest is not just a theoretical concept; it's a powerful force in various investment vehicles. In savings accounts, the interest might be compounded daily, offering a steady, albeit modest, growth of funds. Certificates of Deposit (CDs), on the other hand, typically offer higher interest rates with different compounding frequencies, making them an attractive option for risk-averse investors.

For retirement accounts like 401(k)s and IRAs, the effect of compound interest is particularly profound. These accounts often invest in stocks and bonds, where the returns - and thus the compounding - can be significantly higher than traditional savings accounts.

Understanding how compound interest works in each of these vehicles is key to optimizing your investment strategy.

Using compound interest calculators

Navigating the complexities of compound interest calculations can be simplified with online calculators, such as our own. These tools allow you to input variables such as the principal amount, interest rate, compounding frequency, and investment duration to instantly see potential future values. Here's how to use them effectively:

- Input accurate and realistic numbers, considering the current interest rate environment and your investment horizon.

- Experiment with different compounding frequencies to see their impact.

- Use these calculators to compare different investment scenarios, such as the potential growth of a retirement account versus a standard savings account.

By regularly utilizing these calculators, you can fine-tune your investment strategies and better plan for your financial future.

Strategies to maximize compound interest

To make the most of compound interest, consider these strategies:

- Start Early: The power of compound interest magnifies over time. Starting your investments early, even with smaller amounts, can result in substantial growth due to the compounding effect.

- Regular Contributions: Consistently adding to your investment can significantly enhance the compounding effect, as each contribution starts earning its own interest.

- Higher Compounding Frequencies: Opt for investments with more frequent compounding periods when possible, as they offer better growth potential.

These strategies, when applied thoughtfully, can help in realizing long-term financial goals.

Common misconceptions and pitfalls

Despite its apparent simplicity, compound interest often falls prey to misconceptions. A common one is underestimating its long-term impact, leading to delayed investing. Another pitfall is overlooking the effect of taxes and inflation on your returns. It's crucial to consider these factors in your calculations to gain a realistic understanding of your investment growth.

Conclusion

Understanding compound interest is pivotal in the realm of personal finance and investing. By grasping how it works and its profound impact on investments, particularly over long periods, you can make more informed decisions and significantly boost your financial health. Remember, compound interest isn't just a mathematical concept; it's a tool for wealth creation. Embrace it, and let your investments work for you over time.

Ready to take control of your financial future? Begin today by exploring the power of compound interest. Use the insights and strategies discussed in this article to review your current investments or to start a new investment journey. Experiment with our compounding calculator to see the potential growth of your savings and investments.

Remember, the sooner you start, the more you can benefit from the magic of compounding.